year end tax planning letter 2021

2021 year-end tax letter Published on Oct. Ad E-File Your Taxes for Free.

Business Planner Printable Business Planner Pdf Business Etsy Business Planner Social Media Planner Social Media Checklist

As we write this years tax letter we are reminded of our 2017 edition.

. Quickly Prepare and File Your 2021 Tax Return. While it is said history does not repeat itself sometimes its events are awfully similar. The end of 2021 is notable for a host of reasons.

Download our 2021 Year-End Tax Planning Document by clicking here. For 2021 the standard deduction is 25100 for married filing jointly and surviving spouses 18800 for head of household and 12550 for all other taxpayers. Rarely has sharing a cocktail watching a game enjoying a meal and even engaging in friendly debate seemed so special.

Online Federal Tax Forms. These events have complicated tax planning for individuals and small business owners. 25100 married filing jointly.

18800 head of household. 2021 Year-End Planning Letter. What a year its been.

Expensing is generally available for most depreciable property other than buildings and off-the-shelf computer software. For your convenience the letter is divided into three sections. Over 50 Milllion Tax Returns Filed.

Keeping all that in mind we have prepared the following 2021. Max out their IRA contributions Contributions to an. Ad IRS-Approved E-File Provider.

This is the time to assess your tax outlook for 2021. Use this year-end tax planning letter to get the conversations started with your individual tax clients to help them take a fresh look at their current and future financial health. 2021 Year-End Tax Planning Letter Dear Clients and Friends.

So far we have had to cope with a global pandemic extreme political division and a series of natural disastersjust to mention a few noteworthy occurrences. By developing a year-end plan you can maximize the tax breaks currently on the books and avoid potential pitfalls. The client letter provides Download the Year-End Tax Planning Letter for Individual Clients File name.

Challenges remain at the end of 2021 as the country is still recovering from the pandemic and the fate of the Build Back Better Act BBB is uncertain. TAX 2021 Year-End Tax Planning Letter for Individuals Lucy Luo CPA 22 November 2021 Time is ticking on year-end tax planning as 2021 draws to a close. And 12550 married filing separately.

Add in the 38 surtax on net investment income and the total tax rate would be 288 If passed this new rate would apply to any transactions that occur after September 13 2021. As always please do not hesitate to contact us if you have any concerns or would like to learn more about how to reduce your tax liability. Year-End Tax Tips and Reminders for Individual Tax Payers 2021.

Obtain a draft of the income tax return for the tax year ended _____20XX and compare the items with the Schedule. 13 2021 History repeating. In the fall of 2017 it was unclear whether the Tax Cuts and Jobs Act TCJA would be enacted.

Get a demo today. By developing a comprehensive year-end plan you can maximize the tax breaks currently on the books and avoid potential pitfalls. If another new law is enacted before 2022 it may require you to revise your year-end tax planning strategies.

For 2021 the standard deduction amounts are. For tax years beginning in 2021 the expensing limit is 1050000 and the investment ceiling limit is 2620000. Click Here for 2021 Tax Planning Letter.

Thats right as long as we prepared your 2020 tax return your tax planning. The 25 bracket goes into motion once a taxpayers income exceeds 445850 for single tax filers and 501600 for married couples filing together. Produce critical tax reporting requirements faster and more accurately.

Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. With the end of the year approaching it is a good time to review your 2021 income tax situation and take steps to ensure that you are taking full advantage of the many tax planning strategies available. Before we get to specific suggestions keep in mind effective tax planning requires considering both this year and next year at a minimum.

O Business Tax Planning. Taxpayers should carefully consider the consequences of taking their first RMD now or in the following year as delaying it may cause 2 RMDs to occur in the following year. O Individual Tax Planning.

Compare the amounts included in the Schedule in step 1. Keeping all that in mind we have prepared the following Year-End Tax Letter2021. This letter discusses some options available to help minimize your 2020 tax bill and plan for the years.

2021 Tax Planning Letter. After being adjusted for inflation individual tax brackets for 2021 have increased slightly. For the first time in 40 years taxes on income and wealth transfers may be headed higher making tax planning more important than ever.

100s of Top Rated Local Professionals Waiting to Help You Today. Perhaps most significant for many of us is that after almost two years apart loved ones will gather together for the holidays once again. Due to these election uncertainties it will be extremely difficult for taxpayers and professional advisors to anticipate possible tax changes for 2021.

2020 was a tumultuous year due to Covid-19. For those reaching age 72 in 2021 the distribution can be made up until April 1 2022 thereafter distributions must occur prior to year-end. As a client of RMS Accounting we are pleased to offer you a FREE year-end tax planning appointment.

Wed be happy to set up a planning meeting with you or assist you in any other way. The Tax Cuts and Jobs Act of 2017 TCJA substantially increased the standard deduction amounts thus making itemized deductions less attractive for many individuals. Regardless of uncertainty year-end tax planning opportunities should still be explored.

From Simple to Advanced Income Taxes. For 2021 the top tax rate of 37 percent applies to incomes over 523600 single and head of household 628300 married filing jointly and surviving spouse and 314150 married filing separately.

Accountancy Flyer Diy Canva Accountancy Flyer Template 2021 Editable Canva Us Letter Size Flyer Template For Accountancy In 2022 Consulting Business Tax Preparation Services Business

Bill And Budget Planner Budget Money Planner Business Budget Template

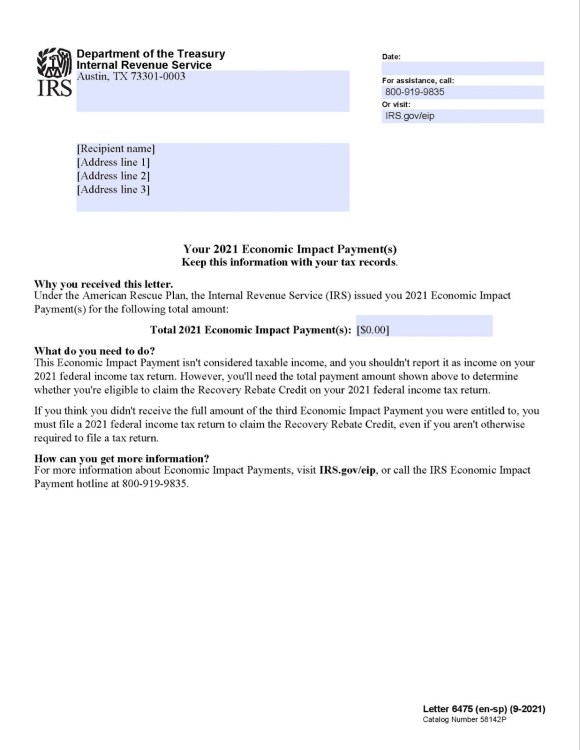

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Tax Deduction Letter Pdf Templates Jotform

Subscribe The Kiplinger Tax Letter

Irs Notice Do S Don Ts Strategic Tax Resolution Llc Irs Finding Yourself Lettering

Subscribe The Kiplinger Tax Letter

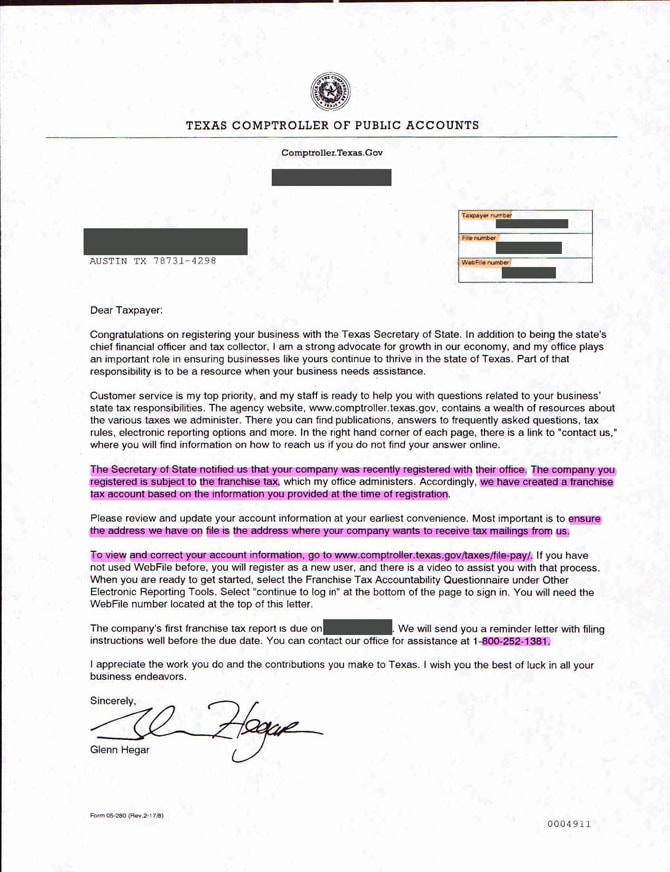

Texas Llc No Tax Due Public Information Report Llc University

How To Get Your W2 Form Online For Free 2021 2022

W 9 Form Download Tax Forms Blank Form Irs Forms

2022 Boho Stylist Planner Nail Tech Esthetician Makeup Artist Etsy Budgeting Monthly Budget Printable Personal Budget

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Our Service List For The Year 2020 Business Card Design Brochure Service

Monthly Income Tracker Budget Planner Template Cash Budget Budgeting

Fillable Form 1040 2019 Income Tax Tax Return Income Tax Return

Dti Permit Blank Business Card Design Black Business Names Event Planning Brochure

Missing A Stimulus Check Irs Letter 6475 Can Help You Claim Recovery Rebate Credit On Taxes Usa Today In 2022 Lettering Irs How To Plan

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Tax Return Financial Statement

Sample General Meeting Agenda Sample Master Template Annual Planning Meeting Agenda Template In 2022 Meeting Agenda Template Agenda Template Meeting Agenda